Shared ownership property

Have you come across a shared ownership property deal? If you are hunting for houses on sites like RightMove you might find a great looking deal. Then, when you click on it, it says ‘shared ownership'. What does it mean? It means you are buying a part of the house, while the other part will be owned by a housing association.

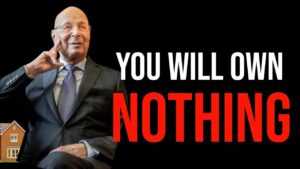

Samuel thinks it's bad. You can't buy a house on a shared ownership scheme and then rent it out. You have to live there. It's for first-time buyers who don't have much money and can only put in a percentage (usually 25-75%). Our property expert believes it's a negative commercial decision to purchase the place you live in. He prefers renting where he lives and owning the places he can rent out.

If something goes wrong in the shared ownership house, the onus is on you to fix it. For example, let's say a boiler breaks – you have to pay for it! You're basically a tenant without any tenant benefits. You only have some of the equity in the property and if you want more, you have to pay. Don't forget the legal and application fees either. However, let's say you do manage to get into the position of owning the whole property. You will only ever have it on a leasehold basis. That means you'll never only the land, you'll always have to pay service charges to the freeholder.

Usually shared ownership properties are new-builds with inflated prices. If you eventually decide to get out of the deal, you can't just sell the house, you have to sell your shares. All in all, if you see ‘shared ownership' written on a property deal, just move past it. It's not a good move and you are likely to regret it.